Let's be honest: figuring out how much to spend on an engagement ring can feel overwhelming. It’s often one of the first major financial decisions a couple makes together. For years, the conversation was dominated by the so-called "three-month salary" rule—a clever marketing gimmick from the 1930s that, frankly, has no place in the modern world.

A real engagement ring budget calculator isn’t some rigid formula; it's a personalized roadmap that respects your financial reality and your future goals. The right number is the one that feels comfortable for both of you, symbolizing your commitment without causing financial stress.

Setting Your Ring Budget Beyond the Old Rules

A thoughtful budget is about more than just a single purchase. It’s a reflection of your shared priorities, your lifestyle, and where you see yourselves in five or ten years. The goal is to start your life together on solid financial ground, not with a mountain of debt.

This means looking beyond outdated rules and having an honest conversation about the bigger picture.

What Are People Really Spending on Rings Today?

To get your bearings, it helps to know what’s happening in the market. In 2025, the average cost of an engagement ring in the U.S. has climbed, with most reports putting the average spend somewhere between $5,200 and $6,800.

That’s a 12% jump from the previous year, pushed by inflation and a growing desire for higher-quality diamonds and custom designs. This signals a shift: people are ditching the old salary rules and budgeting for what they truly value. For a deeper dive into these market shifts, you can read the full research about engagement ring pricing.

But remember, a national average is just that—an average. It’s a useful benchmark, but it shouldn't be your definitive guide. Your personal budget will be unique to your financial situation and priorities.

Key Takeaway: The goal isn't to hit a national average or follow some dusty old rule. The perfect budget is a number that feels comfortable and aligns with your financial goals, ensuring the ring is a symbol of joy, not stress.

Before you even think about carats or cuts, it's time for a financial reality check. The modern approach to budgeting for a ring is flexible and built on honest communication and clear priorities. It requires taking a good look at your complete financial landscape.

To help you get started, here's a look at the factors that truly matter today.

Modern Engagement Ring Budgeting Factors

| Factor | Why It Matters | Example Question to Ask |

|---|---|---|

| Income & Savings | It establishes a realistic baseline. A responsible budget should never touch emergency funds or compromise daily essentials. | "What portion of our discretionary income feels right to allocate to this purchase?" |

| Current Debts | Existing debts (student loans, credit cards) reduce your available funds and can make financing a poor choice. | "How will this purchase affect our ability to pay down our existing debts?" |

| Future Financial Goals | The ring is just one piece of the puzzle. Big goals like buying a house or paying for a wedding need to be factored in. | "Are we saving for a down payment or a big wedding in the next few years?" |

| Partner's Expectations | It ensures you're on the same page. A ring is a shared symbol, so the budget should be a shared decision. | "What's more important to us: a larger stone, or a bigger travel fund?" |

| Financing Options | Knowing your credit score and available financing can open up options, but also comes with interest rate risks. | "Does financing make sense, or should we save up and pay in cash?" |

Thinking through these points helps you build a budget that works for your life, not one dictated by marketing campaigns.

At Precious Pulse Jewelry, we believe an engagement ring should be a beautiful symbol of your commitment, and that starts with a budget you both feel confident about. When you approach it this way, you’re empowered to find a stunning ring without compromising your future.

Nailing Down a Budget That Actually Works for You

Alright, let's move from daydreams to dollars. Pinning down a real number is the most empowering part of this whole process. We’re going to build a realistic budget you feel fantastic about, using a practical framework that respects your financial health—not some outdated rule from your grandparents' generation.

Forget complicated algorithms. A smart engagement ring budget calculator is just a straightforward look at your real-world finances.

First things first: what’s your discretionary income? This is the money you have left each month after covering all the essentials—rent, utilities, groceries, and any debt payments. It's the cash you use for fun stuff like hobbies, dining out, or saving for bigger goals.

Knowing this number shows you what's truly available without adding any financial stress to your life.

The Percentage of Savings Model

Instead of falling for old salary-based myths, a much smarter and safer approach is the Percentage of Savings model. This method is simple: you dedicate a specific portion of your non-emergency savings to the ring. This is crucial because it ensures you aren’t touching your financial safety net or throwing your long-term goals off track.

A healthy and totally responsible range to consider is 10-20% of your dedicated savings. For example, if you have $20,000 set aside for non-essential goals (think travel, investments, or a future down payment), a 15% allocation gives you a solid $3,000 budget.

The beauty of this model is its flexibility. It scales perfectly to your individual financial situation.

Expert Tip: Never, ever dip into your emergency fund for a ring. That money is sacred—it's for true, unexpected life disasters. An engagement ring is a planned, joyful purchase. Keeping these finances separate is the key to a stress-free start to your engagement.

Real-World Budget Scenarios

Every couple's financial picture is different. What works for a young professional just starting their career will look very different from an established couple with dual incomes and fewer debts.

Let's see how this plays out.

-

Scenario One: The Young Professional Alex is 27 and has a steady job, but he's also chipping away at student loans. He's managed to save $10,000 outside of his emergency fund. Using the 10-20% model, his budget comfortably lands between $1,000 and $2,000. This allows him to get a beautiful, meaningful ring without slowing down his debt repayment goals. At Precious Pulse Jewelry, a budget like this could secure a stunning solitaire with a high-quality moissanite or a delicate diamond cluster ring.

-

Scenario Two: The Established Couple Ben and Sarah are in their mid-30s, have two solid incomes, and have been saving for a house. Their joint savings account holds $50,000. They decide to allocate 10% toward the ring, setting a clear budget of $5,000. This feels significant and special but doesn't compromise their down payment timeline one bit. A $5,000 budget opens up incredible options, from a brilliant lab-grown diamond over one carat to an elegant ring with intricate pavé details.

These examples show how a flexible model adapts to different life stages and priorities, making it a far more useful tool than any one-size-fits-all rule. For a deeper dive, you can explore our detailed breakdown of what is a decent amount to spend on an engagement ring for even more perspectives.

Considering Smart Financing Options

What if you don't have the full amount saved right now? Financing can be a good path, but you have to be careful. Many jewelers offer payment plans, often with 0% APR for an introductory period. This can be a great way to manage cash flow, but only if you are disciplined enough to pay off the full balance before that promotional period ends.

Before you sign anything, read the fine print. You need to know what interest rate will kick in after the intro period, because it can be shockingly high. The goal is to use financing as a strategic tool, not a crutch that drags you into unnecessary debt. Ideally, you’ll have a good portion saved for a down payment to keep your monthly payments low and manageable.

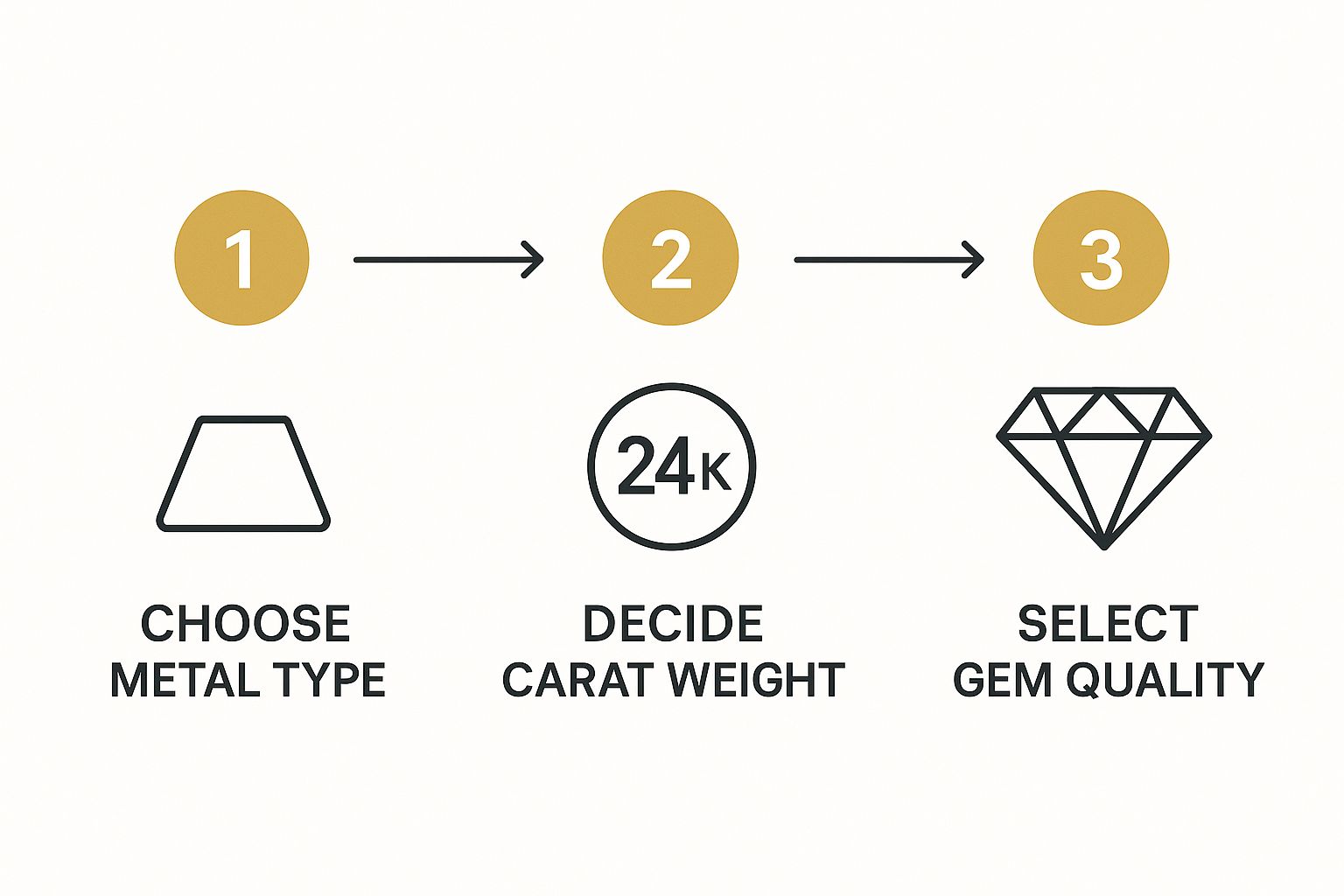

This infographic breaks down the core decisions you'll be making as you decide where your money goes.

This process really highlights how your budget gets distributed across the ring's key components, from the foundational metal all the way to the final gemstone quality.

How to Spend Your Budget: Priorities and Trade-Offs

Alright, you’ve got a budget range in mind. Now for the fun part—deciding how to spend it. This is where you translate those numbers into a ring that truly reflects your partner's style and your shared values.

Think of it less as hitting a specific price point and more as making smart, informed trade-offs.

Every engagement ring is a delicate balance of different features. Is a huge, brilliant diamond the non-negotiable centerpiece? Or is a unique, custom-designed setting what will really make their heart sing? Your answers here will steer every decision you make from this point on.

The Famous 4 Cs: Your Secret Weapon for Value

The "4 Cs"—Cut, Color, Clarity, and Carat—are the universal grading standards for diamonds, and they’re what drive the price tag more than anything else. Understanding how to play with these priorities is how you’ll get the absolute most for your money. You don't need a perfect score across the board to find a jaw-dropping ring.

- Cut: If you only prioritize one thing, make it this. Cut is what gives a diamond its fire and sparkle. A masterfully cut diamond can look bigger and more brilliant, cleverly masking slightly lower grades in color or clarity. It's all about the light performance.

- Color: This actually refers to the lack of color in a white diamond. Sure, a completely colorless diamond (D grade) is the pinnacle, but it's also incredibly rare and expensive. Diamonds in the G-J range are considered "near-colorless" and look just as stunning to the naked eye for a fraction of the cost.

- Clarity: This grade measures the tiny internal flaws (inclusions) or external marks. Here’s the secret: many of these are microscopic and have zero impact on the stone's beauty. Opting for a "VS" (Very Slightly Included) or "SI" (Slightly Included) diamond can unlock huge savings over a flawless one without any visible difference.

- Carat: This is simply the diamond's weight, which corresponds to its size. Prices jump dramatically at popular milestone weights like 1.0 ct. A savvy move is to buy just shy of these marks—a 0.90-carat diamond, for instance—which can save you a surprising amount of money for a visually identical stone.

Expert Takeaway: Pour your budget into the Cut first. It delivers the most visual impact. You can be more flexible on Color and Clarity to free up funds for a more brilliant stone or a slightly larger carat weight.

Think Beyond the Diamond Mine

The modern engagement ring market is so much more exciting than it used to be. You're no longer limited to natural diamonds, and this opens up a world of possibilities for getting the look you want without blowing your budget.

As couples get more creative with their budgets, the options have expanded far beyond just mined diamonds. Lab-grown alternatives can offer 35–60% savings, and other stunning gemstones are taking center stage. These choices are completely changing how people shop for rings.

- Lab-Grown Diamonds: Let's be clear: these are real diamonds. They are physically and chemically identical to their mined counterparts, just created in a controlled environment. They offer incredible value, often allowing you to get a much larger or higher-quality stone for the same amount of money.

- Alternative Gemstones: Sapphires, emeralds, and moissanite are not just "alternatives"—they are gorgeous, durable, and unique choices in their own right. They make a powerful personal statement and are often much more affordable than a diamond of a similar size.

Choosing the stone and setting is a deeply personal journey, just like getting the size right. For help with that crucial next step, our complete engagement ring size guide has everything you need to know.

How Location Impacts Your Ring Cost

It’s a detail that catches so many couples by surprise, but where you buy your engagement ring can dramatically shift the final price. You could find the exact same ring from the same designer, yet see a wildly different price tag in New York City compared to a quiet town in the Midwest. This isn't some arbitrary markup; it's rooted in the real-world costs of running a business.

Jewelers with a physical storefront in a prime city location are juggling some serious overhead. Think about the astronomical rent for a boutique on a famous street, higher local taxes, and the competitive salaries needed to retain expert staff. Those expenses have to go somewhere, and they almost always find their way into the price of that diamond you’re considering.

Why Your Zip Code Matters for Your Budget

The economic vibe of your area plays a massive role. Recent spending data for 2025 throws these regional differences into sharp relief, showing just how much local economies and even cultural norms can influence what people are willing to spend.

For example, the top-spending states include Washington (averaging $10,109), California ($9,482), and Illinois ($9,197). In these areas, it’s not uncommon for a ring to cost 10–13% of the average household income. You can dig deeper into how state spending habits vary across the U.S. to get the full picture.

The trend is pretty clear: places with a higher cost of living and higher average incomes tend to have higher ring prices to match. Knowing this from the start helps you set realistic expectations for what you can get for your money locally.

Let's look at a few examples to see how stark the difference can be.

Average Engagement Ring Spend By State (Examples)

This table gives a snapshot of how much average spending can vary, contrasting some high-cost states with more budget-friendly ones. Notice how factors like major metro areas and average income levels come into play.

| State | Average Spend | Key Factor |

|---|---|---|

| Washington | $10,109 | High-tech industry salaries, major metro hubs like Seattle |

| California | $9,482 | High cost of living, significant wealth in cities like LA & SF |

| South Dakota | $3,005 | Lower cost of living, more rural population |

| Montana | $3,858 | Lower population density, fewer luxury retail markets |

Seeing these numbers side-by-side really highlights why a one-size-fits-all budget doesn’t work. What’s considered a lavish spend in one state might be just the starting point in another.

Key Insight: Don’t get discouraged if the prices in your city feel inflated. This information is your superpower. It helps you become a smarter shopper, whether that means confidently negotiating with a local jeweler or turning to high-quality online jewelers to bypass the local markup.

Once you understand your local market, you can start using that knowledge to find the absolute best value, no matter where you live.

Finding Value Wherever You Are

Your geographical coordinates don't have to box you in or force you to blow your budget. Modern ring shopping has flipped the script, giving you the power to find a stunning ring that aligns perfectly with your engagement ring budget calculator.

Here are a few practical strategies to put into action:

-

Compare Local vs. Online: This is the biggest game-changer. Online retailers like Precious Pulse Jewelry don't have the massive overhead of a brick-and-mortar store, which means we can pass those substantial savings directly on to you. You get to explore a much wider selection from your couch, with zero sales pressure.

-

Look Beyond the City Center: If you have your heart set on buying from a local, in-person jeweler, think outside the box—literally. Drive 30 minutes out to the suburbs. Jewelers in smaller towns just outside major metro areas often have lower operating costs, and their pricing can be much more competitive.

-

Get a Second Opinion: Found a ring you love at a local shop? Great. Get a detailed quote, then head online and compare it with similar rings. This simple step gives you a powerful negotiation tool and ensures you aren't unknowingly paying a premium just because of your zip code.

Smart Strategies to Maximize Your Budget

Alright, you've got a budget range and a list of what matters most. Now for the fun part: making every dollar count. A smart budget isn’t just about setting a spending limit; it’s about knowing the insider tricks to find a ring that looks like it cost a fortune, without actually costing one.

One of the cleverest moves you can make is to shop just shy of those big, round carat weights. Diamond prices take a huge leap at popular milestones like 1.00 and 1.50 carats. But if you opt for a diamond that’s 0.90 or 1.40 carats, you can pocket some serious savings—often 15-20%.

The best part? The size difference is so minuscule that no one will ever spot it with the naked eye. It’s a classic jeweler’s secret.

Focus on Materials for Long-Term Value

The metal you pick for the setting has a big say in both the upfront cost and how much maintenance you'll be dealing with down the road. At first glance, platinum and white gold look like twins, but they couldn't be more different in price and upkeep.

- Platinum: This is the heavyweight champion. It's naturally white, so the color will never fade, and it’s both hypoallergenic and incredibly tough. That durability, however, comes with a higher price tag.

- White Gold: A fantastic, budget-friendly alternative. It’s an alloy of gold and other white metals, finished with a bright rhodium coating. That coating is what gives it its shine, but it will wear off over time and need a touch-up every few years—a small, recurring cost to keep in mind.

Speaking of game-changers, let's talk about lab-grown diamonds. These aren't fakes or imitations; they're chemically and visually identical to natural diamonds, just grown in a lab instead of pulled from the earth. The difference is the price. They cost significantly less, which means you can get a much larger or higher-quality stone for your money.

Insider Tip: By choosing a lab-grown diamond, you can often get a stone that's 30-50% larger for the same price as a natural diamond. It’s the single best way to maximize the visual impact of your ring.

Timing and Trust Are Everything

Finally, when you buy and who you buy from are just as critical as what you buy. Many jewelers, including online specialists like Precious Pulse Jewelry, run sales around major holidays. Think Valentine’s Day, Black Friday, or even Mother’s Day. Planning your purchase to coincide with one of these events can unlock major savings.

Equally important is finding a jeweler you trust. A great jeweler won't try to push you past your budget. Instead, they'll listen to your priorities and act as your guide, helping you balance the 4 Cs to find a hidden gem that delivers incredible sparkle and value. When you combine these strategies, you can walk away with a breathtaking ring that honors both your relationship and your financial goals.

Common Questions About Engagement Ring Budgets

Once you've run the numbers through an engagement ring budget calculator, a few lingering questions are bound to pop up. It’s completely normal. Think of this as the final check-in to make sure you’re feeling confident and clear about your decision.

We've gathered the most common queries we hear to give you straightforward, honest answers.

Does the Ring Budget Include the Wedding Band?

Typically, no. Most couples treat the engagement ring budget as a separate line item from the wedding bands. The bands usually get rolled into the overall wedding expenses, right alongside the photographer and the venue.

However, if you're already dreaming of a perfectly matched bridal set, it’s a brilliant move to factor in the band’s cost from the get-go. Many jewelers, including Precious Pulse Jewelry, offer matched sets that can simplify the process and sometimes offer better value. Discussing this early ensures there are no surprises later.

How Much Should I Actually Save Before Buying?

There's no single magic number, but the healthiest approach by far is to have the full amount saved before you make the purchase. This simple strategy lets you start your engagement on a high note—without the shadow of debt. It’s a fantastic foundation to build your life on.

A responsible way to do this is by using a portion of your dedicated savings, maybe 10-20% of funds that aren't earmarked for emergencies. If you're not quite there yet, it’s much better to create a savings plan and wait a few months than to finance the whole thing. Your shared financial peace of mind is the real prize here.

Key Insight: Open, honest communication about money is one of the strongest pillars you can build in a partnership. An engagement ring is often the first major financial decision a couple makes together, setting a powerful precedent for teamwork.

Is It Okay to Talk About the Budget with My Partner?

Absolutely! In fact, we highly recommend it. An engagement is the first big step in what will become a true financial partnership. Talking about the budget openly ensures you’re both comfortable with the number and that this big purchase aligns with your shared goals—like saving for a house or that dream honeymoon.

This conversation also practically guarantees the final ring is a style your partner will adore for decades to come. To make that chat even more productive (and fun!), you could explore how to choose an engagement ring style together. A team approach from the start builds a rock-solid foundation for everything that comes next.

At Precious Pulse Jewelry, we believe finding the perfect ring should be a joyful experience, free from financial stress. Explore our collection of stunning and affordable engagement rings to find a piece that beautifully symbolizes your love story without compromising your budget.